how are property taxes calculated at closing in florida

Known as a 1031 exchange it allows you to keep buying ever-larger rental properties without paying any capital gains taxes along the way. Regardless of who owns a property the tax rates stay the same.

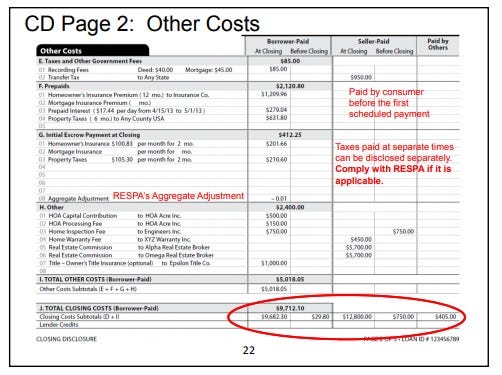

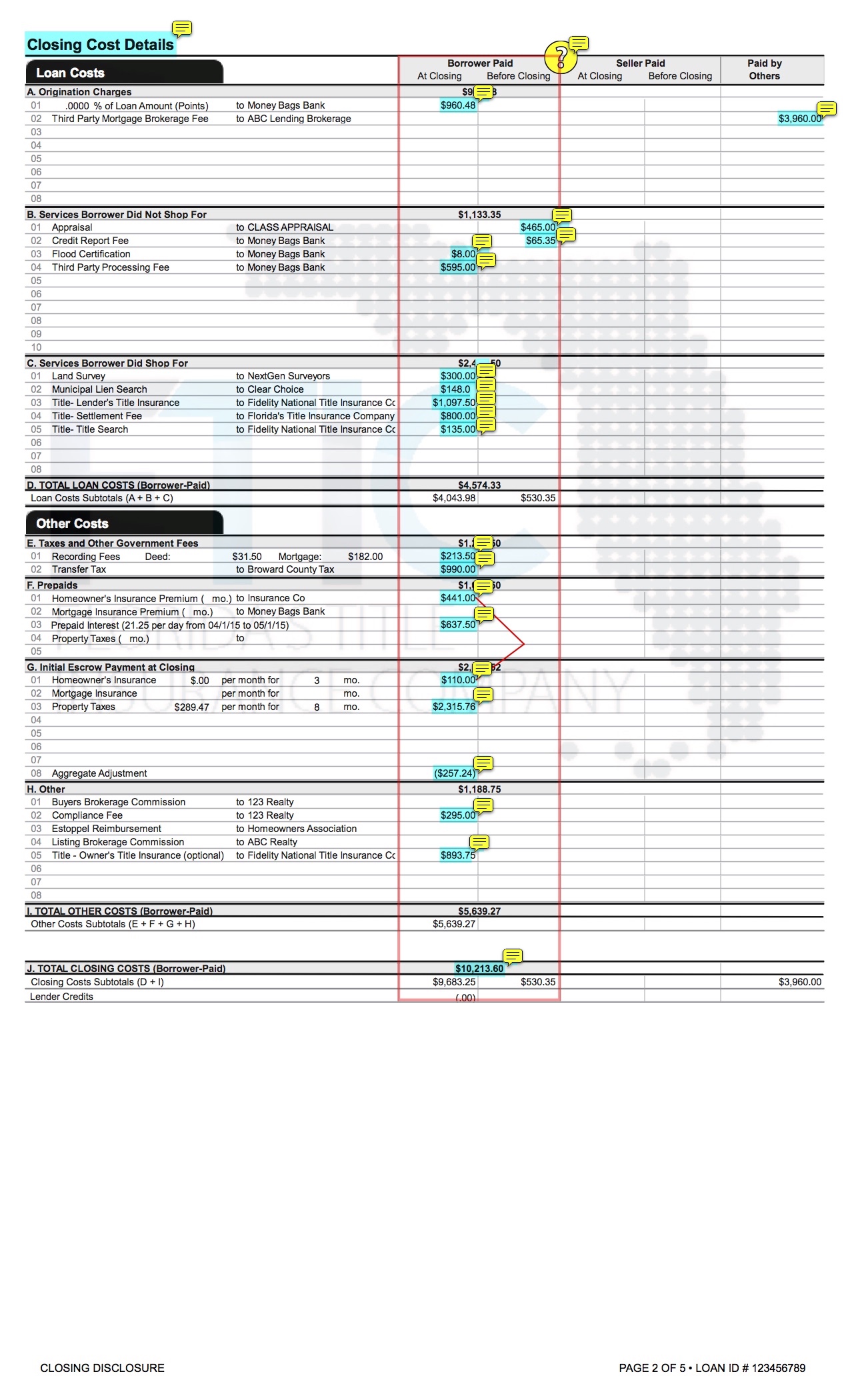

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Your closing date is the day you become the legal owner of your new home.

. The only Florida properties exempt from paying property taxes are schools churches and government properties. Delinquent payments must be received on or before the last working day of the month to be considered paid in that month. Texas Property Tax Rates.

Insured Amount Florida Title Insurance Rates 1 million to 5 million. These TRIM notices sent by the Property Appraiser in August provide homeowners with their estimated property taxes for this year. Floridas equivalent to the transfer tax is the documentary stamp.

Overview of New York Taxes. Property taxes are the responsibility of owners but. Each Floridian must pay these property taxes according to state law.

Overtime these caps can reduce the amount of property taxes paid as they are calculated on assessed value. Closing is the final step before that house is finally freakin yours. Under Florida Law properties are allowed a limit on the amount the assessed value may increase each year known as the homestead Save Our Homes SOH 3 cap and the non-homestead 10 cap.

Transfer TaxDocumentary Stamp Taxes. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on. It works like this.

In common law a deed is any legal instrument in writing which passes affirms or confirms an interest right or property and that is signed attested delivered and in some jurisdictions sealedIt is commonly associated with transferring conveyancing title to propertyThe deed has a greater presumption of validity and is less rebuttable than an instrument signed by the party. The local property appraiser sets the assessed value to each property effective January 1st each year. Postmark date is not proof of payment once a tax is delinquent.

They are calculated based on the total property value and total revenue need. Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. In New York City property tax rates are actually quite low.

Every state has a transfer tax of some sort which is essentially a fee the state charges to transfer a property from one party to the other. As we near the end of summer and the kids have gone back to school it is time for property tax season to begin with the mailing of the property tax TRIM Truth In Millage notices sent to each property owner. Property taxes in New York vary greatly between New York City and the rest of the state.

In a lawsuit filed Tuesday the city charges that it erroneously paid its landlord over 270000 in real estate taxes between 2014 and 2022. Do a 1031 Exchange. During the contract negotiation phase you the buyer and the seller set a closing date which must be listed on the purchase agreement contract.

Delinquent property tax cannot be paid online. The IRS lets you swap or exchange one investment property for another without paying capital gains on the one you sell. Property tax is delinquent on April 1 and is subject to penalties and interest.

In a given area however they typically do not change drastically year to year. The average effective property tax rate in the Big Apple is just 088 while the.

Understanding Property Taxes At Closing American Family Insurance

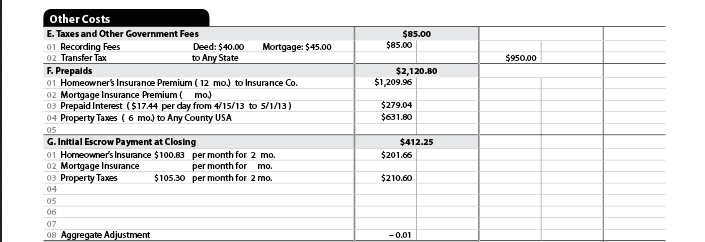

Closing Costs Real Estate Infographic Real Estate Tips Buying First Home

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Closing Costs In Florida What You Need To Know

Midpoint Realty Cape Coral Florida Brochure Call Us Or Email Ad Condos For Sale Cape Coral Florida Boxes Easy

Hidden Costs Of Buying A Home Home Buying Buying Your First Home Buying First Home

Blog Royal Shell Real Estate Real Estate

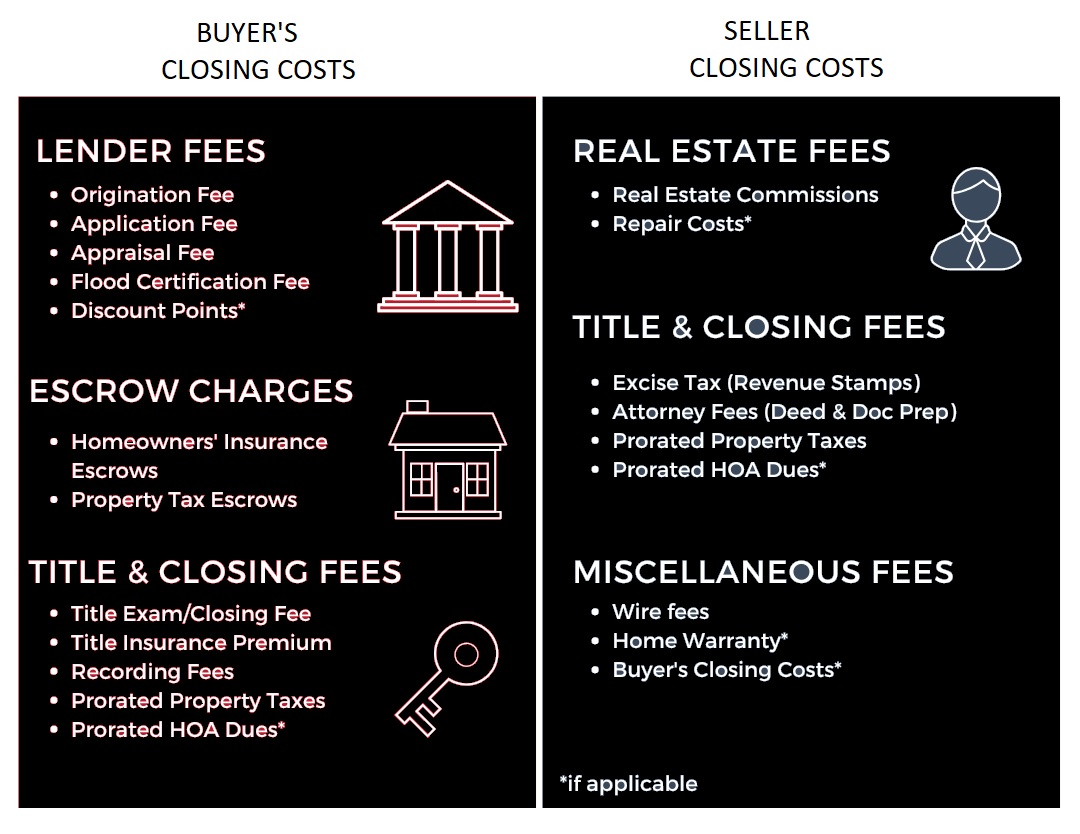

Your Guide To Property Taxes Hippo

Property Tax Prorations Case Escrow

The Buyers Guide To Closing Costs Florida Realtors Home Buying Checklist Real Estate Education Real Estate Buyers

Smart Faqs About Maryland Property Taxes Smart Settlements

Property Tax How To Calculate Local Considerations

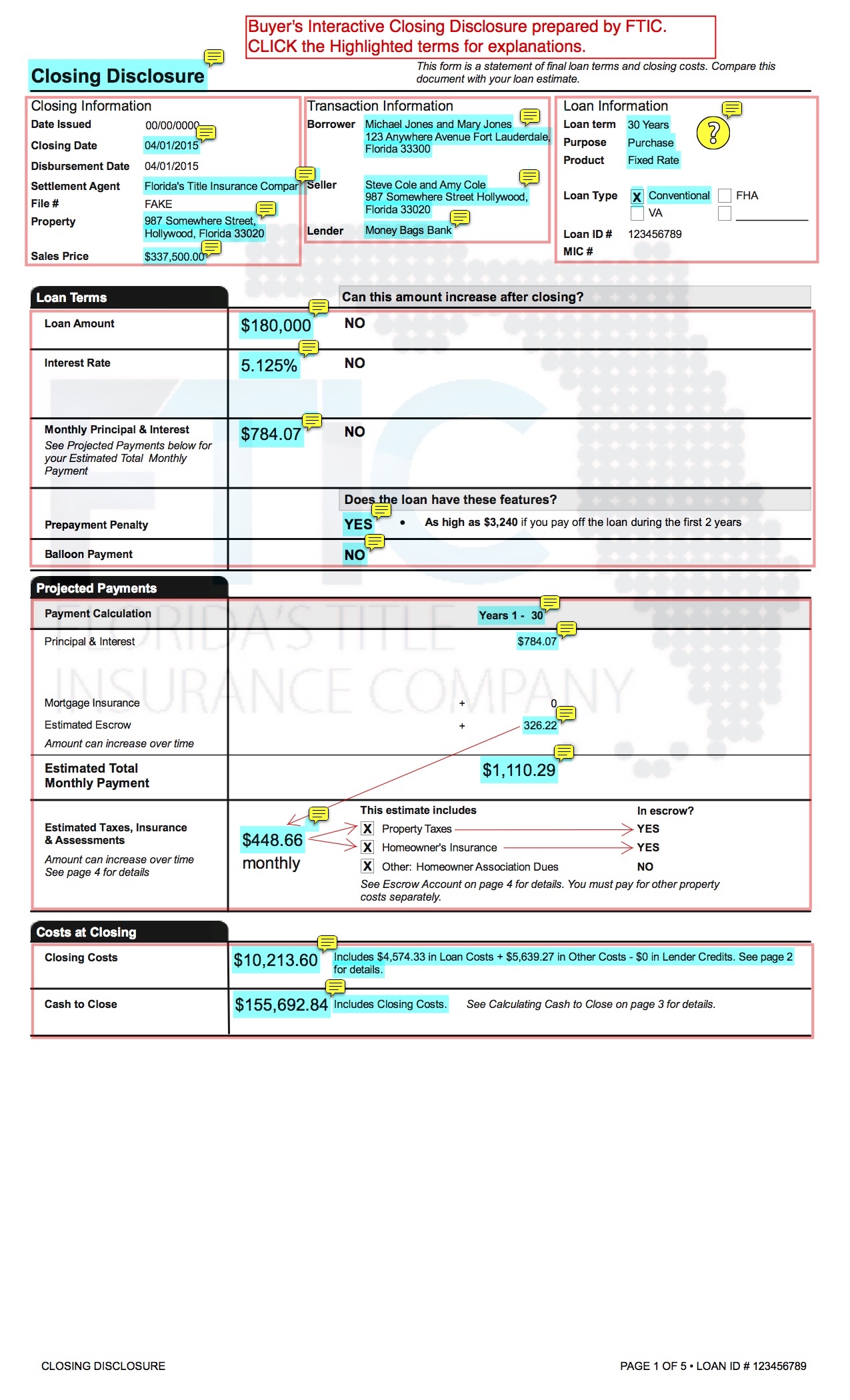

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Closing Costs That Are And Aren T Tax Deductible Lendingtree

First Time Home Buying From A First Time Home Buyer Buying First Home Home Buying Home Buying Process

How To Compute Real Estate Tax Proration And Tax Credits Illinois