how much is meal tax in massachusetts

Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax. The tax is levied on the sales price of the meal.

Massachusetts Could Make Free Breakfast And Lunch For All Students Permanent

Massachusetts Cigarette Tax.

. Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625. The sale of food products for human consumption is exempt from the sales tax. How much will the Massachusetts tax rebate be.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor If a liquor license holder operates a restaurant where meals are served. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

Multiply the cost of an item or service by the sales tax in order to find out the total cost. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Exemptions to the Massachusetts sales tax will vary by state.

How much is tax on food in Massachusetts. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. Before August 1 2009 the tax rate was 5.

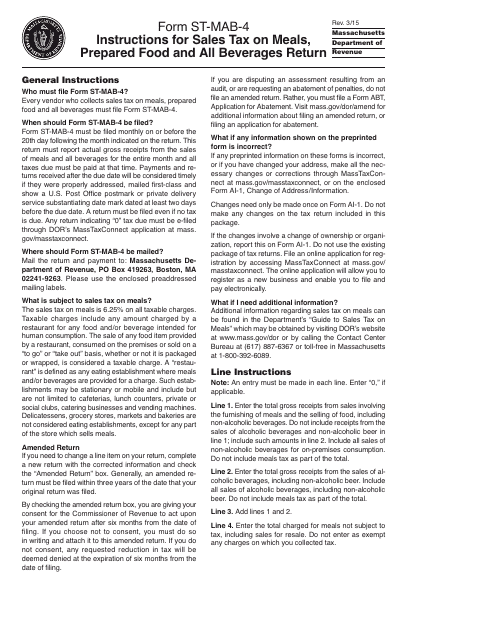

Total tax to be collected. Massachusetts Department of Revenue. To learn more see a full list of taxable and tax-exempt items in Massachusetts.

In addition to the state excise Massachusetts cities and towns are permitted to charge a local room occupancy excise tax up to 6 65 for Boston. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. The base state sales tax rate in Massachusetts is 625.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax. Note that while the statute provides for a 5 rate an uncodified surtax adds 7 to that rate.

Clothing has a higher tax rate when you spend over 175and a special local sales tax of 075 may apply to meals purchased in some localities. Additionally the tax nexus demands that the vendor be fully registered with the Massachusetts Department of Revenue must file their returns properly and settle their back taxes to avoid the likelihood of a tax audit. Clothing purchases including shoes jackets and even costumes are exempt up to 175.

Massachusetts meals tax vendors are responsible for. A local option for cities or towns. The tax is 625 of the sales price of the meal.

The Massachusetts sales tax is imposed on sales of meals by a restaurant. The meals tax rate is 625. LicenseSuite is the fastest and easiest way to get your Massachusetts meals tax restaurant tax.

The tax is 625 of the sales price of the meal. How much is the inheritance tax in Massachusetts. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. The meals tax rate is 625. The original refund proposed in Bakers budget was for 250 intended for individual filers who earned between 38000 and 100000 last year and.

How is meal tax calculated. The buyer pays the sales tax as an addition to the purchase price to the vendor at the time of purchase. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or rented in Massachusetts.

A state excise tax. Item or service cost x sales tax. A 625 state meals tax is applied to restaurant and take-out meals.

Please note that the sample list below is for illustration purposes only and may contain licenses that are not currently imposed by the jurisdiction shown. The meals tax. A product that costs more than 175 is taxable above that amount so a 200 pair of shoes would be taxed at 625 on the 25 above the exemption limit.

Find your Massachusetts combined state and local tax rate. If you need any assistance please contact us at 1-800-870-0285. The states room occupancy excise tax rate is 57.

Anyone who sells meals that are subject to sales tax in Massachusetts is a meals tax vendor. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain telecommunications services 1 sold or rented in Massachusetts. Most food sold in grocery stores is exempt from sales tax entirely.

A state sales tax. More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. How much is tax on food in Massachusetts.

The Massachusetts Meals Tax rate is 625 on every meal sold by restaurants. This page describes the taxability of food and meals in Massachusetts including catering and grocery food. The base state sales tax rate in Massachusetts is 625.

Massachusetts has a 625 statewide sales tax rate and does not allow local governments to collect sales taxes. 830 CMR 64H65 1 b lists the sections contained in 830 CMR 64H65. Before August 1 2009 the tax rate was 5.

Massachusetts local sales tax on meals. The equation looks like this. The tax is 625 of the sales price of the meal.

Douzo Sushi Back Bay Sushi Sushi Dishes Cuisine

Fresco S Roast Beef Seafood Menu In Malden Massachusetts Usa

Tracing The Origin Of The Massachusetts Sales Tax

Download Instructions For Form St Mab 4 Sales Tax On Meals Prepared Food And All Beverages Return Pdf Templateroller

Online Menu Of Mezzo Mare Restaurant Hull Massachusetts 02045

Meals Tax Helps Budget Gaps In Massachusetts Cities And Towns Masslive Com

How To Calculate Meals Tax For Restaurants Ma Santorinichicago Com

Massachusetts Sales Tax Small Business Guide Truic

Charlie Baker Outlaws Lunch Shaming In Massachusetts

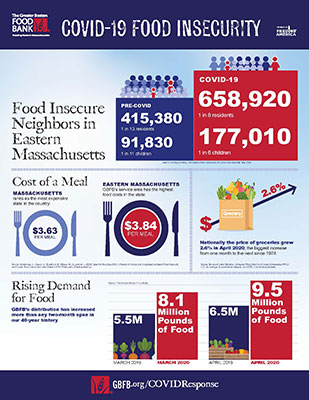

New Projections For Eastern Mass Show 59 Increase In Food Insecurity

Celebrate Thanksgiving With Us At 189 Prime Steak And Seafood Prime Rib Roast Fresh Turkey

Burger Recipes Home Burger Burger Dogs Double Burger

Is Food Taxable In Massachusetts Taxjar

Fight Celiac Disease And Fertility Problems With Gluten Free Diets Gluten Free Help Gluten Free Living Gluten Free Diet

Blue Cross Blue Shield Of Massachusetts Responds To Rising Food Insecurity Jun 1 2020